Cryptocurrency exchanges play a vital role in the digital asset ecosystem by enabling users to buy, sell, and trade cryptocurrencies. However, one of the key aspects that traders must consider before using any exchange is the fee structure. Understanding how these fees work is crucial for managing trading costs effectively and optimizing profits. In this article, we’ll provide a comprehensive overview of cryptocurrency exchange fees, their types, and how platforms like SwapGate, developed by White Label Exchange, offer a transparent and user-friendly fee structure.

Types of Fees on Cryptocurrency Exchanges

Cryptocurrency exchanges typically charge several types of fees, each serving a specific purpose. Below are the most common types:

Trading Fees

Trading fees are applied when users execute buy or sell orders on the exchange. These fees are often categorized into two types:

- Maker Fees: Charged when a user places an order that adds liquidity to the market (e.g., a limit order that isn’t immediately filled).

- Taker Fees: Charged when a user places an order that removes liquidity from the market (e.g., a market order).

Exchanges often incentivize market makers by offering lower fees compared to takers, as liquidity improves the overall trading experience.

Deposit and Withdrawal Fees

- Deposit Fees: Some exchanges charge fees for depositing funds, although this is less common for cryptocurrency deposits. Fiat deposits, however, may incur fees depending on the payment method.

- Withdrawal Fees: Charged when users move funds out of the exchange to external wallets. These fees typically cover blockchain transaction costs.

Network Fees

Network fees are not charged by the exchange itself but by the blockchain network. For example, transferring Bitcoin or Ethereum involves miners validating the transaction, which incurs a fee.

Spread Fees

Some exchanges include a spread fee, which is the difference between the buy and sell price of an asset. This fee is often hidden but can significantly impact the overall cost of a trade.

Inactivity Fees

A few exchanges charge inactivity fees for accounts that remain dormant for extended periods. While not universal, this fee is worth noting.

Factors Influencing Exchange Fees

The fee structure on cryptocurrency exchanges can vary widely based on several factors:

- Trading Volume: High-volume traders often receive discounted fees as part of tiered fee structures.

- Membership Levels: Premium accounts or loyalty programs may offer reduced fees.

- Payment Methods: Using credit cards or bank transfers for deposits and withdrawals can incur additional charges.

- Network Congestion: During periods of high activity, network fees for popular blockchains can spike.

- Exchange Type: Centralized exchanges (CEXs) and decentralized exchanges (DEXs) have different cost structures due to the nature of their operations.

How Our Solutions Simplify Fees

At White Label Exchange, we design cryptocurrency exchange solutions that prioritize transparent and competitive fee structures. Our platforms address common fee-related concerns by focusing on simplicity, fairness, and user trust.

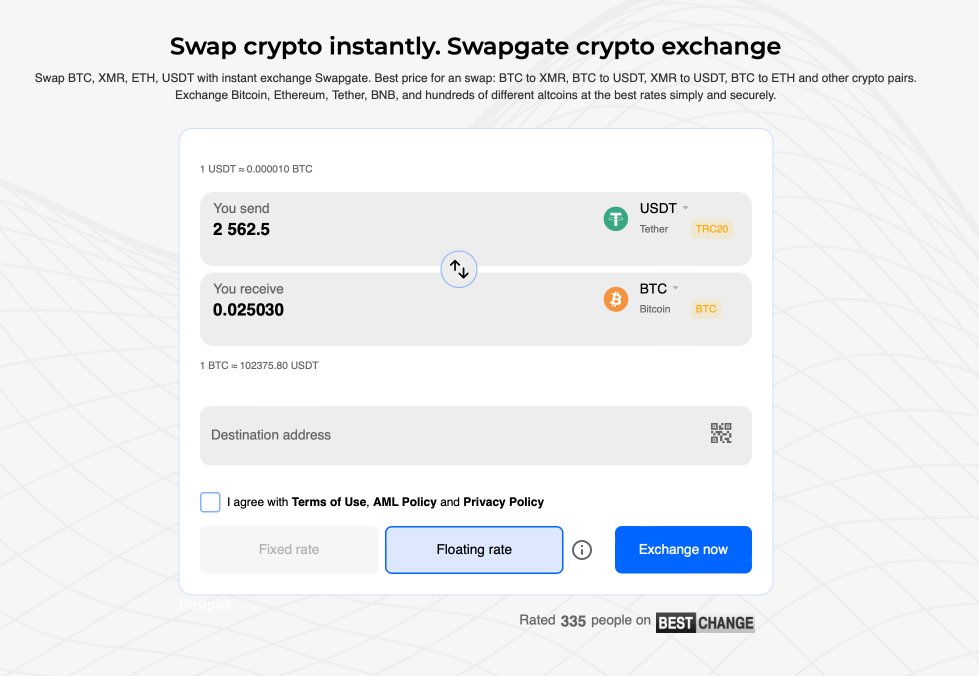

We implement a clear fee model where users are shown all applicable costs upfront, ensuring there are no hidden charges. Our solutions often incorporate competitive maker-taker fees, encouraging users to contribute liquidity while maintaining reasonable costs for market orders. Deposit fees for cryptocurrency transactions are typically waived, while withdrawal fees are optimized to reflect current network costs, offering users a fair price for moving funds. By avoiding hidden spread fees, our platforms provide accurate and transparent pricing for every trade.

Additionally, our user-friendly interfaces are designed to make fee structures easy to understand for both beginners and experienced traders. This balance of functionality and transparency ensures that users can focus on trading without being bogged down by unclear or excessive costs.

Advantages of SwapGate Fee Structure

SwapGate approach to fees offers numerous advantages for traders and businesses alike. Cost efficiency is a primary benefit, as users can maximize their profitability without being burdened by excessive charges. Transparency builds trust, a crucial factor in the cryptocurrency industry where hidden fees can quickly erode user confidence.

For businesses, SwapGate provide the flexibility to customize fee structures according to their specific target audience. This allows enterprises to maintain a profitable operation while catering to the unique needs of their users. Additionally, the scalability of our platforms ensures they can handle increasing trading volumes and user growth without compromising on performance or fee fairness.

By prioritizing transparency, fairness, and user-centric design, SwapGate fee structures contribute to a seamless and trustworthy trading experience. This holistic approach ensures that both users and businesses can benefit from our cryptocurrency exchange solutions.

Tips for Managing Fees on Crypto Exchanges

While platforms like SwapGate provide cost-effective solutions, users can further optimize their trading costs by following these tips:

- Choose the Right Exchange: Look for platforms with transparent and competitive fee structures, like SwapGate.

- Opt for Limit Orders: Reduce trading fees by placing limit orders instead of market orders.

- Utilize Native Tokens: Some exchanges offer fee discounts for using their native tokens.

- Monitor Network Activity: Avoid high-fee periods by checking network congestion levels.

- Consolidate Transactions: Combine smaller transactions to reduce withdrawal fees.

Conclusion

Understanding how fees work on cryptocurrency exchanges is essential for making informed trading decisions. From trading fees to withdrawal costs, every charge can impact your profitability. SwapGate, developed by White Label Exchange, stands out as a secure, transparent, and cost-effective platform that prioritizes user satisfaction.

With features like a transparent fee model, zero deposit fees, and competitive maker-taker rates, SwapGate addresses common concerns and simplifies the trading experience. Whether you’re a casual trader or a business looking for a reliable exchange solution, SwapGate’s approach to fees ensures a seamless and affordable trading environment.

To learn more about SwapGate and how White Label Exchange is redefining crypto trading, visit their official website and explore the future of cryptocurrency exchanges.